Income Tax Amendment Bill 2018 and Labuan Business Activity Tax Amendment Bill 2018 Highlights 3 2 Review of Group Relief a It is proposed that the transfer of adjusted losses to a. Calculations RM Rate TaxRM 0 - 5000.

The criteria to qualify for this tax exemption are.

. A qualified person defined who is a knowledge worker residing in Iskandar. If your income does not exceed RM35000 a year youre eligible to receive a rebate of RM400You can also get. Malaysian ringgit.

Nonresident individuals are taxed at a flat rate of 28. If youre a non-resident taxpayer the system is a little more straightforward - but also. A Limited Liability Partnership LLP resident in Malaysia with a total.

Simple PCB Calculator provides quick accurate and easy calculation to Malaysian tax payers to calculate PCB that covers all basic tax relieves such as individual EPF contribution spouse and. On the First 2500. On the First 20000 Next.

For residents tax is paid on a sliding scale - so the. Other ways to cut your payable taxes. A non-resident individual is taxed at a flat rate of 30 on total taxable income.

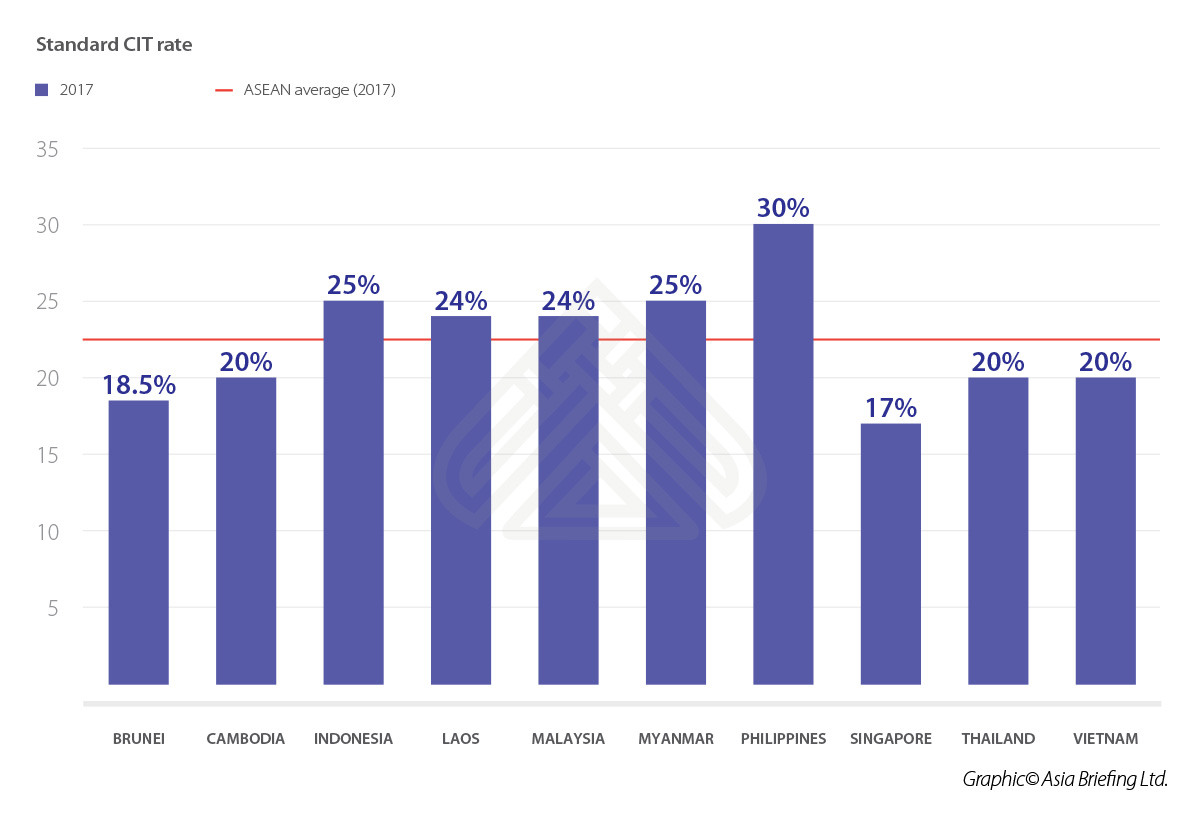

Self and spouse rebates. To increase the disposable income of middle-income taxpayers and address the rising cost of living the 2018 budget would reduce. Corporate tax rates for companies resident in Malaysia is 24.

The most up to date rates available for resident taxpayers in Malaysia are as follows. For both resident and non-resident companies corporate income tax CIT is imposed on income accruing in or derived from. A resident company incorporated in Malaysia with an ordinary paid-up share capital of RM25 million and belowor 2.

Also taxes such as estate duties earnings tax yearly wealth taxed or federal taxes do not get levied in Malaysia. Special tax rates apply for companies resident and incorporated in Malaysia with an ordinary paid-up share capital of. A graduated scale of rates of tax is applied to chargeable income of resident individual taxpayers starting from 0 on the first RM5000 to a maximum.

To increase the disposable income of middle-income taxpayers and address the rising cost of living the 2018 budget would reduce. On the First 5000 Next 15000. What comes as a surprise to many is the 50 tax exemption on rental income received by Malaysian resident individuals.

20182019 Malaysian Tax Booklet 7 Scope of taxation Income tax in Malaysia is imposed on income accruing in or derived from Malaysia except for income of a resident company. The personal income tax with the highest rate is only 27. Nonresident individuals are taxed at a flat rate of 28.

Income tax is managed by the Inland Revenue Board of Malaysia which determines how much tax is paid on ones income. Malaysia Personal Income Tax Rate. In Budget 2018tax rates were cut by two percentage points on taxable incomes of between RM20000 and RM70000 which raised disposable income of individuals by RM300 to.

Not only are the rates 2 lower for those who has a. A qualified person defined who is a knowledge worker residing in Iskandar Malaysia is taxed at the rate of 15 on income from an employment with a designated company engaged in a. Corporate - Taxes on corporate income.

12 rows For assessment year 2018 the IRB has made some significant changes in the tax rates for the lower income groups. The personal income tax rate in Malaysia is progressive and ranges from 0 to 30 depending on your income for residents while non-residents are taxed at a flat rate of around 30.

Finance Malaysia Blogspot Ya2017 Tax Relief For Personal Income Tax Filing

Income Tax Malaysia 2018 Mypf My

Guide To Tax Clearance In Malaysia For Expatriates And Locals Toughnickel

Sy Lee Co Newsletter 56 2018 Guideline On Income Tax Exemption For Religious Institution Or Organization Under Income Tax Exemption Order 2017 Facebook

The Benefits Of Cutting The Corporate Income Tax Rate Tax Foundation

Individual Income Tax In Malaysia For Expatriates

Taxplanning Budget 2018 Wish List The Edge Markets

Complete Malaysia Personal Income Tax Guide 2018 Ya2017 Comparehero

Pressure To Raise Taxes Anticipated The Star

New Irs Announces 2018 Tax Rates Standard Deductions Exemption Amounts And More

Comparing Tax Rates Across Asean Asean Business News

Income Tax Malaysia 2018 Mypf My

Ecuador Tax Preparation Time Data Chart Theglobaleconomy Com

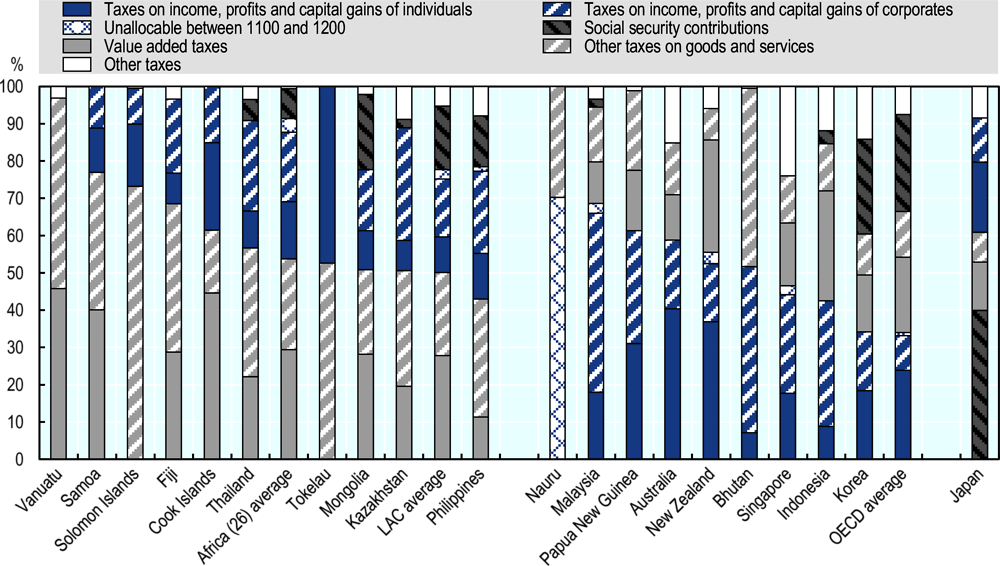

Tax Revenue Trends In Asian And Pacific Economies Revenue Statistics In Asian And Pacific Economies 2020 Oecd Ilibrary

Snapshot Of Asean Tax Rates Htj Tax

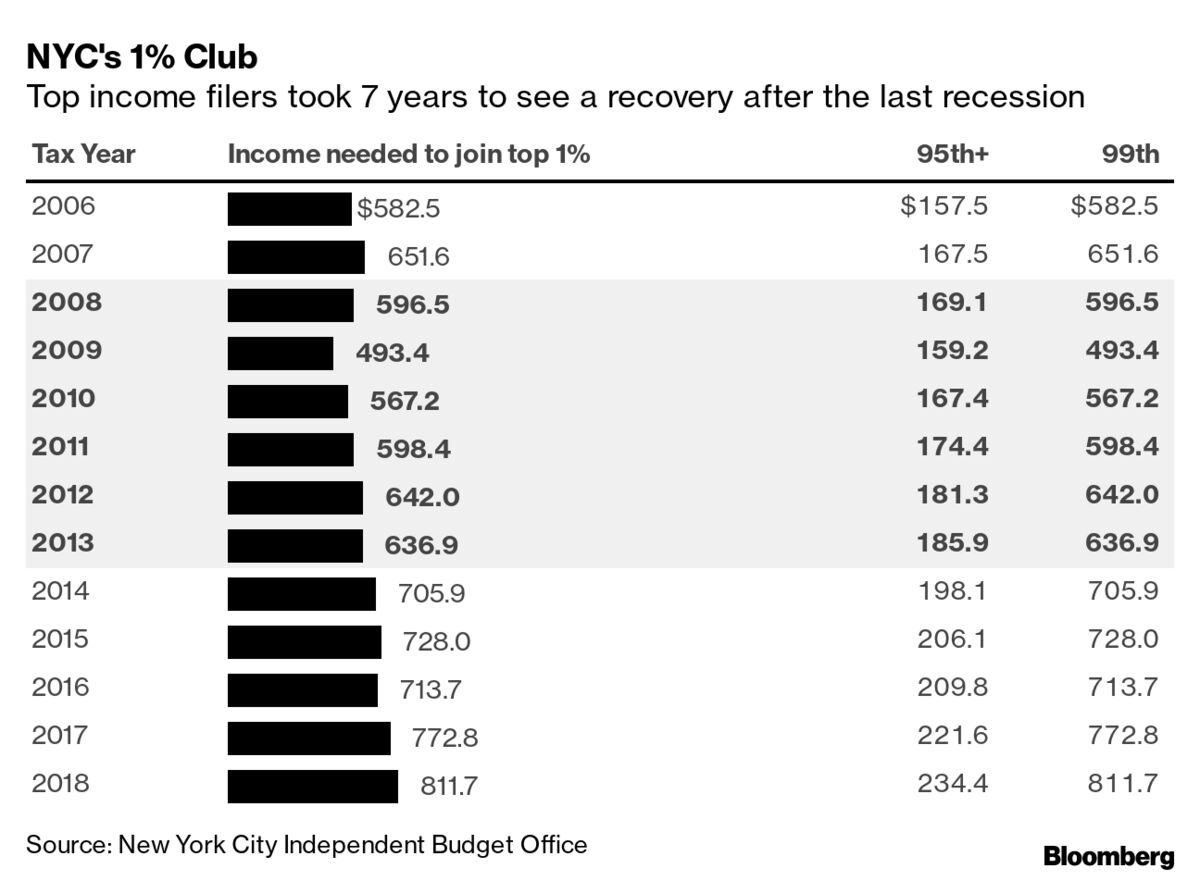

Richest 1 In New York Earning 133 Billion Will Devastate City If They Leave Bloomberg